Mastering Spanish: The Ultimate Guide To “Money” Terminology

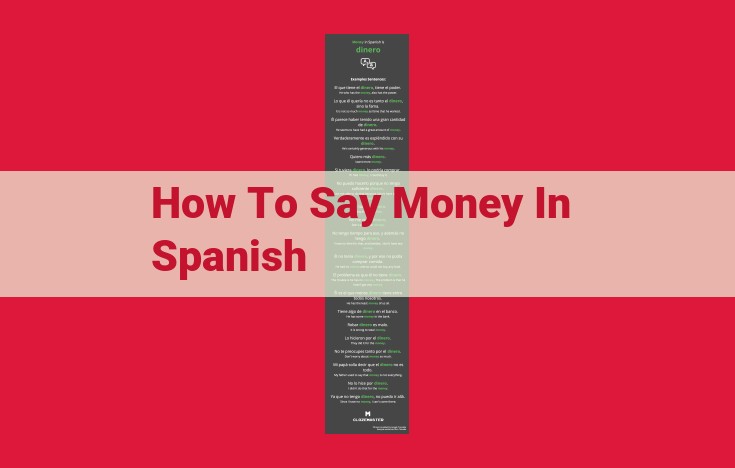

To say "money" in Spanish, use "dinero". For more specific terms, use "moneda" for currency, "billete" for banknote, and "moneda" or "vuelto" for change.

Central Concepts of Currency

Currency, a medium of exchange that facilitates transactions and serves as a store of value, plays a critical role in our daily lives. It comes in diverse forms, both physical and digital.

Physical Currency:

Coins and banknotes, tangible representations of value, have served as currency for centuries. Coins, often minted from precious metals like gold or silver, have historical and intrinsic value beyond their nominal worth. Banknotes, paper or polymer-based, represent a promise to pay the bearer the stated amount.

Digital Currency:

In the digital age, electronic currencies have gained prominence. These include virtual currencies like Bitcoin and Ethereum, as well as digital versions of traditional currencies issued by central banks. Digital currencies offer convenience, anonymity, and the potential for faster and cheaper transactions.

Regardless of its form, currency serves as the lifeblood of our financial system. It enables us to purchase goods and services, invest in businesses, and store our wealth. Understanding its composition and the role it plays in our daily lives is paramount for financial literacy.

Financial Infrastructure: The Backbone of Currency Management

In the intricate tapestry of the global economy, the health of our currency is paramount. This is where the financial infrastructure steps into the spotlight, like a maestro conducting the symphony of financial transactions. At the heart of this infrastructure lies financial institutions, such as banks and central banks, who serve as the guardians of our currency and the facilitators of our financial endeavors.

Banks: The Gatekeepers of Financial Transactions

Think of banks as the gatekeepers of our financial world. They receive our deposits, guard our savings, and facilitate our loans, ensuring the smooth flow of funds throughout the economy. By acting as intermediaries between individuals and businesses, banks provide access to financial services for all.

Central Banks: The Regulators and Controllers

Central banks, on the other hand, play the role of watchdogs, ensuring the stability of our currency and the health of the financial system. They possess the power to set interest rates, issue new currency, and regulate the activities of commercial banks. By wielding these tools, central banks aim to control inflation, promote economic growth, and maintain the integrity of our financial markets.

Units of Measure

- Discuss the various units used to measure currency (e.g., dollar, euro, yen) and their conversion rates.

Units of Measure: Untangling the Currency Labyrinth

When it comes to understanding the world of finance, units of measure play a crucial role in navigating the complexities of currency. Just as different countries have unique languages, currencies have distinct units that define their value and allow for comparisons across borders.

One of the most widely recognized units of currency is the dollar. The US dollar, represented by the symbol $, is used in the United States and several other countries worldwide. Its stability and global acceptance make it a benchmark for international trade and investment.

Another prominent unit of measure is the euro. Introduced in 1999, the euro is the official currency of the European Union. Its strength and widespread usage within the EU have made it a key player in global financial markets.

Moving east, the yen emerges as a dominant currency in Asia. The Japanese yen, denoted by the symbol ¥, is known for its stability and economic growth. Japan's strong economy and trade partnerships have fueled the yen's prominence.

These units of measure are but a few examples of the diverse currency landscape. Each unit carries its own history, economic significance, and exchange rates. Understanding the connections and conversion rates between different currencies is essential for global commerce, investment, and financial planning.

Financial Jargon and Expressions: A Translator for Your Currency Journey

Don't let financial lingo leave you in the dark! Understanding the language of currency can be daunting, but it's essential for navigating the world of finance with confidence. Let's explore some common phrases and expressions that you may encounter.

Inflation: The Rising Tide That Lifts (or Sinks) All Boats

Inflation refers to the gradual increase in prices over time. It's a measure of how expensive goods and services become compared to previous years. While moderate inflation can be beneficial, excessive inflation can erode the purchasing power of your money, making it harder to buy the things you need.

Interest Rates: The Cost of Borrowing and Saving

Interest rates are the charges or rewards you pay or receive for lending or borrowing money. When you borrow money, the interest rate determines the cost of that loan. On the other hand, if you save money in an interest-bearing account, the interest rate determines the return you earn on your savings.

Credit Scores: The Financial Fingerprint that Determines Your Worthiness

Credit scores are numerical ratings that assess your creditworthiness, or ability to repay debt. Lenders use credit scores to evaluate the risk of lending you money. A high credit score can qualify you for lower interest rates and better loan terms, while a low credit score can make it harder to obtain credit at all.

Understanding the Financial Lexicon Empowers You

By familiarizing yourself with these and other financial terms, you can stay informed and make sound financial decisions. It's like having a translator at your fingertips, allowing you to navigate the world of currency with confidence. Don't let financial jargon hold you back—embrace it, understand it, and use it to your advantage.

Related Concepts: The Interconnected Web of Currency

Beyond its fundamental properties and practical applications, the concept of currency is deeply intertwined with a myriad of related concepts that shape its significance and impact on economic systems. Join us as we delve into these essential connections:

-

Economic Growth: Currency serves as a catalyst for economic growth by enabling transactions and facilitating the exchange of goods and services. Stable and predictable currency systems foster investment, innovation, and overall economic expansion.

-

Monetary Policy: Central banks play a pivotal role in shaping currency values and economic outcomes through monetary policy. By managing interest rates and controlling the money supply, they aim to manage inflation, stabilize economic growth, and mitigate financial instability.

-

Financial Markets: Currencies are at the heart of financial markets, where investors and institutions engage in the buying and selling of stocks, bonds, and other financial instruments. The value and stability of currencies significantly impact the performance and risk appetite in these markets.

Related Topics:

- Aprenda Português Fluentemente: Guia Essencial Para Escrita E Fala

- How To Pronounce “Barista” Correctly: A Comprehensive Guide

- How To Pronounce “Decimal”: A Guide To Correct Pronunciation

- Unveiling The Building Blocks Of Language: Phonology

- The Meaning Of “Soleado” In Spanish: Sunny Days And Clear Skies